Premise: Providing liquidity is NOT for everybody, as it comes with risks such as impermanent loss (best explained by this article) – risks as well as eligibility criteria are detailed in T&C, that need to be approved before participating our Program. In particular please note that this Program is not for consumers, but for professionals conducting business activities in crypto

On August 30, 2023, a program to incentivize liquidity for the LAKE-ETH pair on Uniswap V3 was launched. According to the program, 60 million LAKE tokens are being distributed for 12 months to those who stake LAKE-ETH LP tokens on Data Lake’s dApp. If you haven’t read the article about the program yet, click here.

In this article instead, we will illustrate step-by-step how to become a liquidity provider for the LAKE-ETH pair and participate to the incentives program. Ready? Let’s get to it!

Step 1: Have LAKE and ETH in your wallet

The premise for providing liquidity is to own LAKE and ETH – ideally so that their countervalue in US dollars is of 50%/50% – in your wallet. Don’t forget to keep some extra ETH at hand to pay for the gas fees!

If you already fulfill this requirement, then go straight to step 2. If instead you lack of LAKE, ETH or both of them, or want to make so that they have the same countervalue in dollars, consider using our dApp to:

-

Buy ETH using your credit card directly on our dapp through our integration with Transak. To do so, connect your wallet to our dapp, open the “Buy Crypto” menu, and click on “Buy ETH”, then proceed with the purchase.

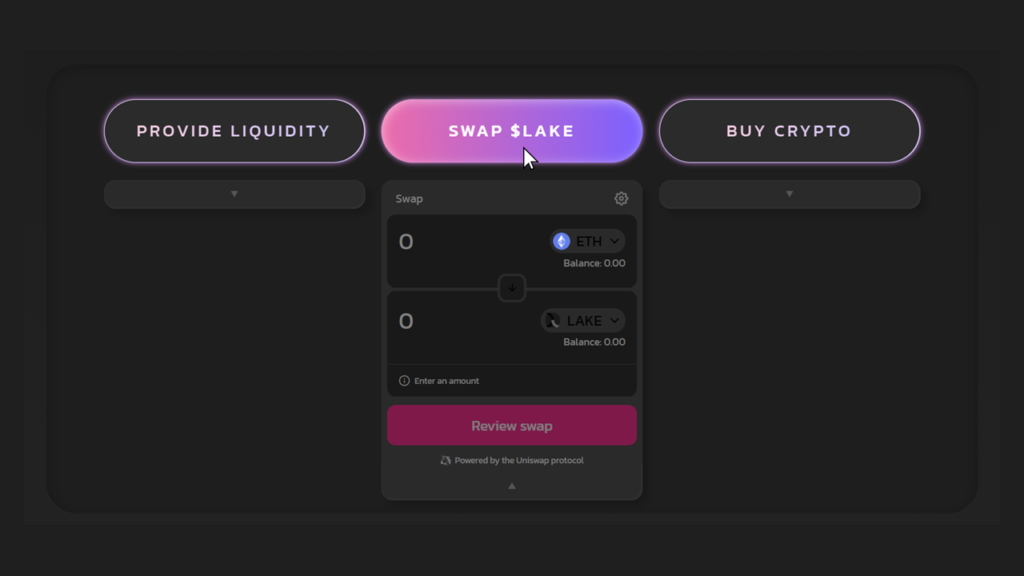

- Buy LAKE in a safe environment using our integrated swap shortcut of the DEX Uniswap. To do so, click on “Swap LAKE”, then choose the amount of ETH you want to convert to LAKE and complete the swap by approving the transaction on your wallet.

Step 2: Provide Liquidity

The second step is to put together ETH and LAKE into an LP token, so to become an LP provider and participate to the liquidity of LAKE on Uniswap V3. To do so, from our dApp, click on the “Provide Liquidity“ menu and click once again on “Provide Liquidity”. From the panel to create the LP, choose the amounts of LAKE and respective ETH you want to use to create the LP.

Once done, you will need to approve up to 4 transactions from your wallet, namely:

-

Approve Lake

-

Approve WETH

-

Wrap ETH

-

Provide LP

Make sure each of these transactions is successfully approved. If you encounter any issues during the approval of these transactions and do not immediately see your ETH in your wallet, don’t worry. In such cases, your ETH has likely been securely wrapped into WETH and remains in your wallet.

If you prefer to, you can also create LP directly on Uniswap V3!

Step 2: Expert mode

If you’re an expert and wish to personalize your LP position, you can click on the ⚙️ icon above in the panel to set the slippage and deadline as well as to choose a different range than the 0-∞ standard one. On Uniswap V3 in fact, you can choose to provide liquidity for specific ranges of price.

Note however that:

-

changing the range also affects the amount of each tokens needed to create the LP, and that

-

you would be eligible to receive your share of the LAKE dedicated to the LP incentives program only if your position is active, meaning that the LAKE-ETH pair is being traded at a price included in the range you selected.

If you don’t feel comfortable with personalizing and tracking your position, then you can just maintain the standard range 0-∞.

Step 3: Stake your LP

As a confirmation of the fact that you provided liquidity, you’ll receive an NFT in your wallet that represents your position. At this point, you are effectively providing liquidity for LAKE on Uniswap, and the last step to start receiving your portion of LAKE dedicated to the incentives program is to stake this NFT on our dapp.

To do so, go to dapp.data-lake.co and then on “Staking“. Once initialized and approved the staking transaction, if you are eligible to the program, you’ll start accruing your share of the LAKE tokens!

And that was the end of this tutorial! At this point, you should be able to create an LP and stake it into the smart contract that distributes the LAKE of the reward program starting from your holdings of LAKE and ETH.

If you still have doubts, join our Telegram community and don’t hesitate to ask your questions, share your thoughts, or seek clarification on any aspect of the tutorial.

FAQ

How do I claim my LAKE rewards?

Because of how Uniswap is built, once your LP is staked on dapp.data-lake.co, you’ll need to unstake your position first and then click on the “Claim Rewards” button to receive the LAKE rewards in your wallet.

How does the incentives program work?

To increase both the use-cases of the LAKE token, as well as the liquidity, Data Lake has announced in this blog article that, starting from 30 August at 23:59:59 CET, 2023, 60 million LAKE tokens will be linearly assigned over the 12 months that follow to reward LAKE-ETH Uniswap V3 liquidity providers on our dapp dapp.data-lake.co.

What happens when the program will be over?

Once the program, which lasts 12 months, will be over, the team will assess with the community how the campaign went and consider incentives to continue the program in the coming years.

How can I withdraw my LP and retrieve the ETH and LAKE tokens that compose it?

You can withdraw your LP tokens and retrieve the ETH and LAKE tokens that compose it anytime. To do so, click on your position in the “Staking” section on dapp.data-lake.co to unstake it, then go to “Remove Liquidity“ and approve the transactions from your wallet to retrieve the LAKE and ETH tokens that compose the LP.