Introduction

At Data Lake, we are committed to safeguarding our users’ funds and protecting the interests of our community and investors. As we step into a new quarter, we believe it’s essential to reassess our liquidity across various exchanges.

Recent events have highlighted the importance of transparency in market activities. Notably, the U.S. Securities and Exchange Commission (SEC) has intensified scrutiny on market makers, holding projects accountable for practices like creating fake volumes and market manipulation (SEC Press Release, 2024-166).

Neither Data Lake nor any of our partners have never engaged in such activities. We take pride in maintaining transparency and protecting our users from issues like insider trading and manipulative practices. Our commitment to integrity is evident in our track record and our dedication to disclosing all relevant information, ensuring the safety and trustworthiness of the LAKE token.

This report will provide an in-depth look at our on-chain liquidity management, including the decision on finalizing the delisting process on Bitget and addition of liquidity to the main pool, as we continue to foster a transparent and reliable environment for our community.

A Peak Into Numbers

During the third quarter of 2024, our trading activity data reveals a strong preference among our community for decentralized exchanges (DEXs), specifically Uniswap, over centralized exchanges (CEXs). The trading volume on Uniswap reached approximately $2.5 million in Q3, while our estimates indicate that organic volume on Bitget was significantly lower, around $800,000. This lower volume on Bitget can be attributed to the fact that each buy order is counterbalanced by a market maker’s sell order and vice versa, with prices closely mirroring those on the DEX. This setup has led most users to favor Uniswap, as it offers a more autonomous and liquid trading environment, without the need of transferring funds out of their wallets.

Additionally, Uniswap provides users the opportunity to earn by contributing liquidity, an option not available on CEXes. Through liquidity provision on Uniswap, over $75,000 was earned by liquidity providers in Q3 alone (excluding potential impermanent loss). Over the past year, our partner, Data River has also contributed 60 million LAKE tokens to incentivize liquidity, which, at the current token price, represents over $180,000. These incentives underscore the team’s commitment to supporting a liquid and accessible market on DEXs for our community.

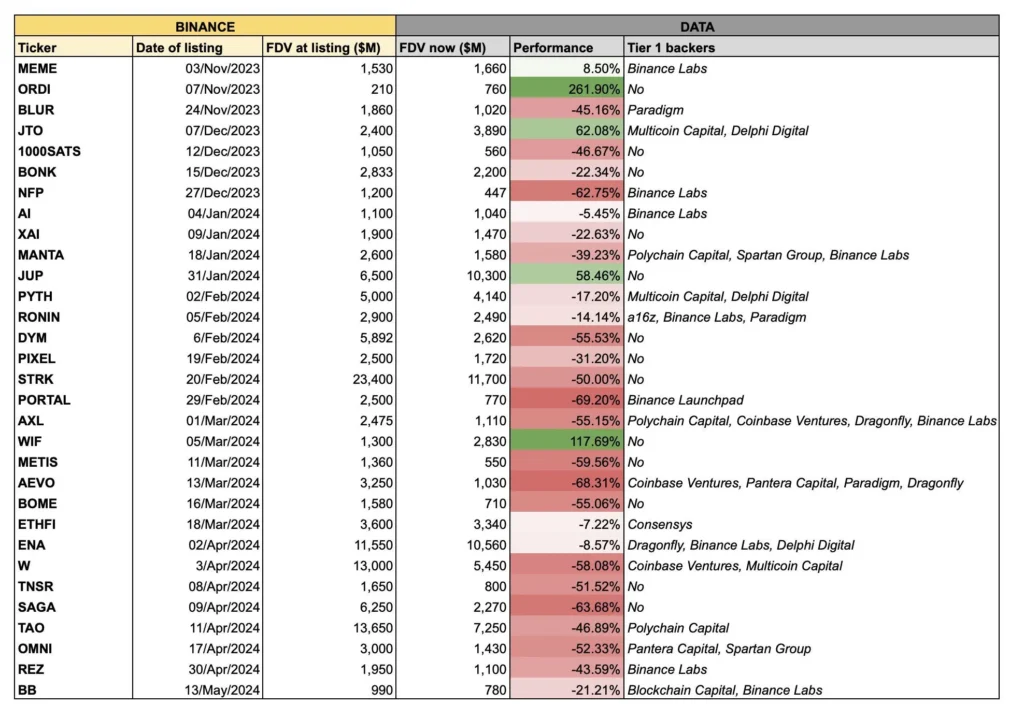

This data clearly highlights that while CEX listings, like our milestone on Bitget, served their purpose in increasing accessibility, the focus among our users has remained on DEXs. Feedback from the community aligns with recent industry insights, like those shared by Nelli Orlova from InnMind (source) or Simon Dedic from Moonrock Capital (source). They pointed out that CEX listings rarely drive price rallies or volume increases; in fact, many tokens listed on major CEXs this year have seen a decline of 60-90%. This reliance on CEXs for price support has been problematic, as it diverts valuable resources without yielding the expected benefits.

Centralized Exchanges and Market Expectations

Engaging with centralized exchanges (CEXs) presents specific challenges and requirements for projects, often entailing commitments that are hard to fulfill without artificial intervention. When listing on a CEX, projects must typically:

-

Pay a Listing (Marketing) Fee: This fee, which can be substantial, is intended to fund marketing activities designed to promote the token on the exchange.

-

Provide Liquidity: Projects are required to fund liquidity pools on the exchange, ensuring a steady flow of trades to meet pre-set Key Performance Indicators (KPIs) for liquidity and stability.

-

Maintain Daily Trading Volume: Exchanges often set volume-based KPIs, which projects are expected to meet. If a project cannot organically generate this volume, it often results in the need to engage a market maker to artificially create volume.

The U.S. Securities and Exchange Commission (SEC) has recently intensified its stance against market manipulation, particularly targeting projects and exchanges that artificially inflate trading volumes. The SEC’s latest enforcement actions (SEC Press Release, 2024-166) reveal their commitment to holding projects accountable for fake volumes, which mislead investors and erode market integrity. This crackdown emphasizes that regulatory bodies are paying closer attention to how trading volumes are generated and highlights the risks associated with these practices.

Even complying with these strict agreements does not guarantee unrestricted access to the exchange. Attempting to withdraw any assets from a CEX account can sometimes result in frozen accounts and blocked funds. During our time of being listed on a CEX, our partner company Data River, responsible for $LAKE token listing, has experienced this firsthand on their private company assets – while complying with all the requirements. This is a risk we are unwilling to accept for our companies or our community, as it puts both the organizations and our users at risk.

These requirements can put significant pressure on projects that don’t naturally achieve high trading volumes. For projects unable to sustain these volumes organically, there is an expectation to “fill the gap” by employing market-making services. Unfortunately, these are the practices we cannot support.

Going forward

Our approach has always been grounded in transparency, focusing on organic growth and protecting our community from the risks of insider trading, wash trading, and other market manipulations. We prioritize the integrity of our platform and uphold the principles of transparency and accountability in all LAKE-related activities, as evidenced by our track record and open disclosures.

As the regulatory landscape evolves, it becomes even more crucial for projects to maintain genuine trading practices. We remain committed to these standards, choosing not to compromise our values to meet exchange KPIs that could potentially harm our community and misrepresent our project’s actual trading dynamics.

In alignment with our Q4 2024 roadmap, $LAKE on-chain liquidity has been increased to better support our community and token holders. Today, at 08:15 CET, over $20,000 in liquidity has been added to Uniswap, demonstrating team’s commitment to transparent, on-chain growth (see transaction).

As we evaluate our partnerships, we find it essential to work with platforms that align with our vision and core values. We rely on objective, data-driven decisions, and the data has clearly indicated that continuing our presence on Bitget no longer aligns with our mission. Consequently, we decided to finalize the delisting process on Bitget. For more details on the delisting, please refer to Bitget’s official announcement, that is expected to follow shortly.

Looking ahead, we remain deeply committed to our community and investors. We are working diligently to identify a new exchange partner to join our ecosystem in the future, though we cannot disclose specifics at this time. In the meantime, our focus will be on strengthening community engagement and bolstering our DEX activity, ensuring a more transparent and decentralized experience for our users.

Yours,

Data Lake & Data River Team